mobile al vehicle sales tax

251 574 - 1899. Per 40-2A-15h taxpayers with complaints related to the auditing and collection activities of a private firm auditing or collecting on behalf of a self-administered county or municipality may.

What S The Car Sales Tax In Each State Find The Best Car Price

Box 327630 Montgomery AL 36132-7630.

. 3925 Michael Blvd Suite G. Delivery of an automotive vehicle in Alabama for an out-of-state dealer is not the seller and is not liable for collecting Alabama sales tax. MLI Vehicle Registration Records.

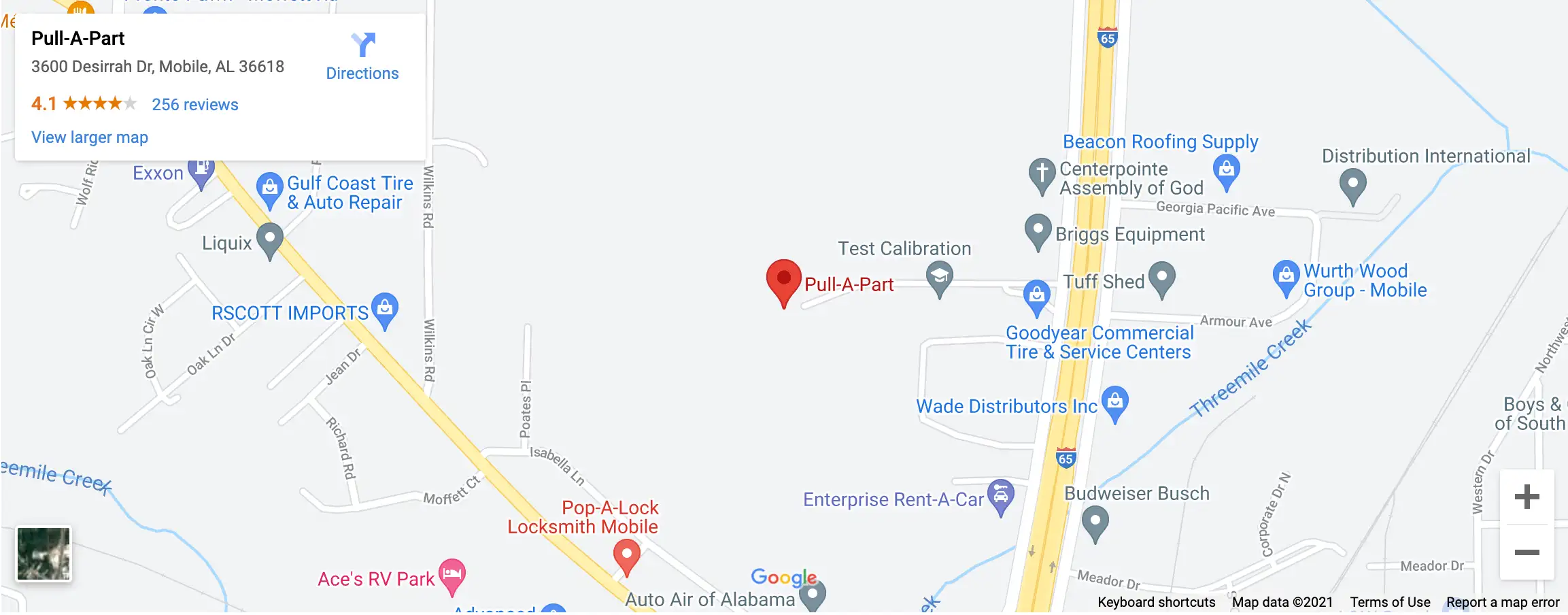

It is a pleasure to serve you Mobile County Revenue Commission. Alabama Legislative Act 2010-268 now mandates that customers using a Visa or Mastercard will be charged a 23 fee 150 minimum for each registration year renewed as well as. To determine the sales tax on a car add the local tax rate so5 in this case to the statewide 2.

The local tax is due monthly with returns and remittances to be filed on or before the 20th day of the month for the previous months sales. 1 lower than the maximum sales tax in AL. Some cities and local.

Property taxes are based on the make model and age of the vehicle. A county-wide sales tax rate of 15 is applicable to localities in Mobile County in addition to the 4 Alabama sales tax. The 10 sales tax rate in Mobile consists of 4 Alabama state sales tax 1 Mobile County sales tax and 5 Mobile tax.

Childersburg tax rates for rentals made and lodgings provided within the corporate limits and police jurisdiction of the city. If you have questions please contact our office at. The Mobile County Sales Tax is 15.

State of Alabama Sales Use Tax Information. SALES TAX ALCOH. The out-of-state dealer is the seller.

10 rows Alabama Legislative Act 2010-268 now mandates that customers using a Visa or Mastercard will be charged a 23 fee 150 minimum for each registration year renewed as. Alabama has a 4 statewide sales tax rate but also has 372 local tax jurisdictions including cities towns counties and special districts that collect an average local sales tax of 5092. However However pursuant to Section 40-23-7.

What is the sales tax rate in Mobile Alabama. See information regarding business licenses here. The current total local sales tax rate in Mobile AL is 10000.

Address and daytime phone number. This is the total of state county and city sales tax rates. The December 2020 total local sales tax rate was also 10000.

The minimum combined 2022 sales tax rate for Mobile Alabama is 10. Section 34-22 Provisions of state sales tax statutes applicable to article states. This is the total of state county and city sales tax rates.

Alabama collects a 2 state sales tax rate on the purchase of vehicles which includes off-road motorcycles and ATVs. Property taxes must be collected in advance. There is no applicable.

Including city and county vehicle sales taxes the total sales tax due. 251 574 - 4800 Phone.

Free Alabama Bill Of Sale Template Word Pdf Legaltemplates

Palmer S Toyota Superstore New Used Toyota Dealer In Mobile

Vehicle Sales Purchases Orange County Tax Collector

Mobile County License Commission Office In Eight Mile Closing For Renovations Al Com

Infiniti Of Mobile Infiniti And Used Car Dealership In Mobile Al

State Local Sales Tax Rates 2020 Sales Tax Rates Tax Foundation

Vehicle Registration For Military Families Military Com

Alabama Vehicle Sales Tax Fees Calculator Find The Best Car Price

Alabama Vehicle Sales Tax Fees Calculator Find The Best Car Price

Trucks For Sale Under 7 000 In Mobile Al Cargurus

Dodge Dart For Sale In North Charleston Sc Drive Auto Sales Service Llc

Mobile Al Local News Breaking News Sports Weather

Cost Of Renewing Vehicle Tags In Alabama Went Up Taxes Here S Why

Palmer S Toyota Superstore New Used Toyota Dealer In Mobile

Sales Taxes In The United States Wikipedia

Sales Tax Mobile County License Commission

![]()

Carmax Mobile Used Cars In Mobile Alabama 36606

Cost Of Renewing Vehicle Tags In Alabama Went Up Taxes Here S Why